A Better Way To Invest:

Dynamic Portfolios

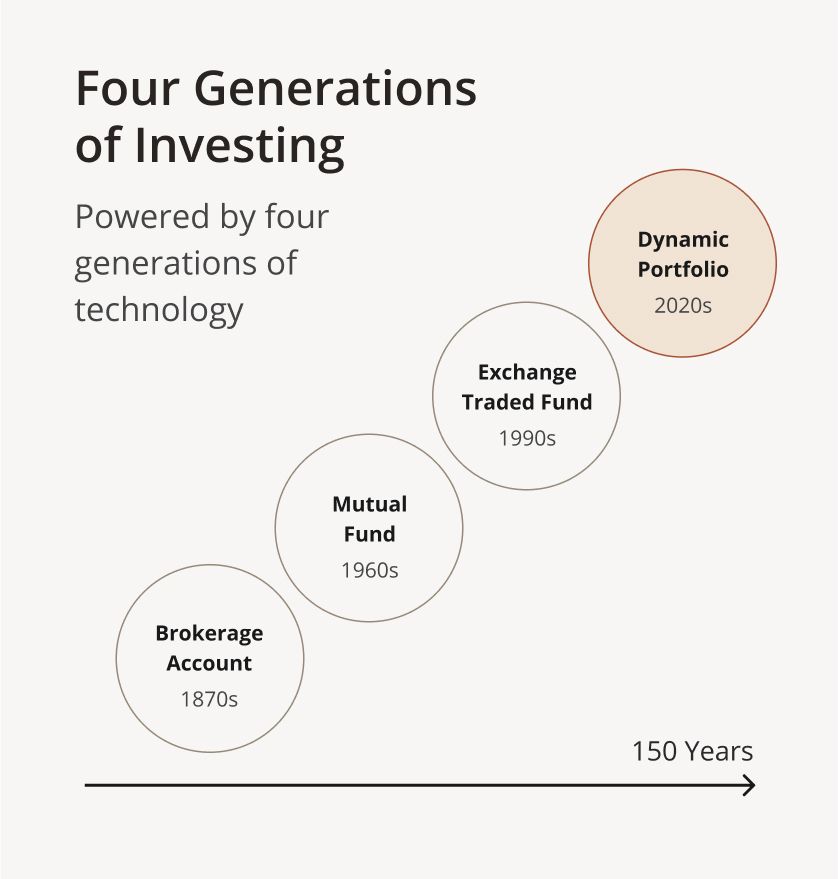

The Next Evolution In Investing

Today’s state-of-the-art solution is the Dynamic Portfolio. It delivers the benefits of an ETF, plus extreme personalization and advanced tax optimization.

What Sets Dynamic Portfolios Apart?

Your One-of-a-Kind Portfolio

Evidence-Based Investing

Optimal Risk-Adjusted Return

Avoidance of Common Mistakes

Higher After-Tax Performance

Portfolios Built Around You

Automated Tax Intelligence That Works Year Round

Fiduciary Guidance

Turn Your Losers into Tax Winners

Optimized by Account Type

Precision DIY Can’t Match

Not all wealth systems are built the same

How it Works

1. Define Your Picture

2. Design & Build

3. Monitor & Optimize

One Fee. Straightforward Pricing.

(over $1M up to $5M)

(over $5M up to $10M)

Get the Strategy

Your Wealth Deserves

What You Need to Know About How We Invest

A Dynamic Portfolio holds hundreds of individual stocks directly rather than pooling them in a single fund. This allows for daily tax-loss harvesting, customization around your values and sector preferences, and more. This provides flexibility and tax-management capabilities that go beyond what most traditional index funds can deliver. It is designed to maximize the tax efficiency of your portfolio and help you keep more of what you earn.

With direct indexing, you own hundreds of individual stocks in your portfolio rather than a single ETF or mutual fund. This allows us to implement tax-loss harvesting by selling specific positions at a loss—even when the overall index is up—unlocking potential tax benefits that can improve after-tax returns, especially for investors in higher tax brackets. Tax-loss harvesting can increase the after-tax return on your stocks by up to 29%, based on our analysis of a Vanguard study. Direct indexing also enables asset location strategies, helping us decide how to position investments across taxable and tax-deferred accounts to reduce taxes across your entire portfolio.

A Dynamic Portfolio is a personalized index of individual stocks tuned to your goals, risk tolerance, tax rate, and values. Unlike one-size-fits-all ETFs, mutual funds, or model portfolios, direct ownership lets us adjust exposures, reflect your values, manage concentration limits, and harvest losses. The result is a portfolio aligned to the market and designed for after-tax performance.

We monitor portfolios continuously and look for opportunities to harvest losses daily. When certain thresholds are met, we sell eligible positions to capture tax losses while keeping your overall investment exposure aligned with your strategy.

Yes. We can customize your portfolio to reflect your personal values and preferences. This can include excluding specific companies or industries, limiting exposure to certain sectors, or incorporating investment themes you care about. The goal is to align your investments with what matters most to you while still maintaining diversification and risk balance.

Yes. If you have a concentrated stock position, we can work with you to manage it in a tax-smart way, gradually transitioning out over time, or hold it separately if that aligns with your strategy. Our goal is to help reduce risk while considering tax impact and your long-term objectives.

Evergreen Wealth charges a single, all-inclusive advisory fee based on assets under management. It starts at 0.07% per month on the first $1,000,000 and decreases as your assets grow. There are no extra fees for planning, trading, or custody, and we do not charge anything on banking deposits. Fees are billed monthly at month-end.

(over $1M up to $5M)

(over $5M up to $10M)

Yes. Evergreen Wealth requires a minimum balance of $250,000 to start and maintain a relationship. This helps ensure our personalized tax strategies and portfolio approach are aligned with your financial profile. We may decline or discontinue a relationship if the balance falls below this threshold.

Yes. You can move eligible investments directly to your Evergreen Wealth account without selling them first, a process known as an in-kind transfer or Automated Customer Account Transfer Service (ACAT). This helps you avoid triggering unnecessary taxes and allows for a smoother, more tax-efficient transition.