The Benefits of Tax-Loss Harvesting

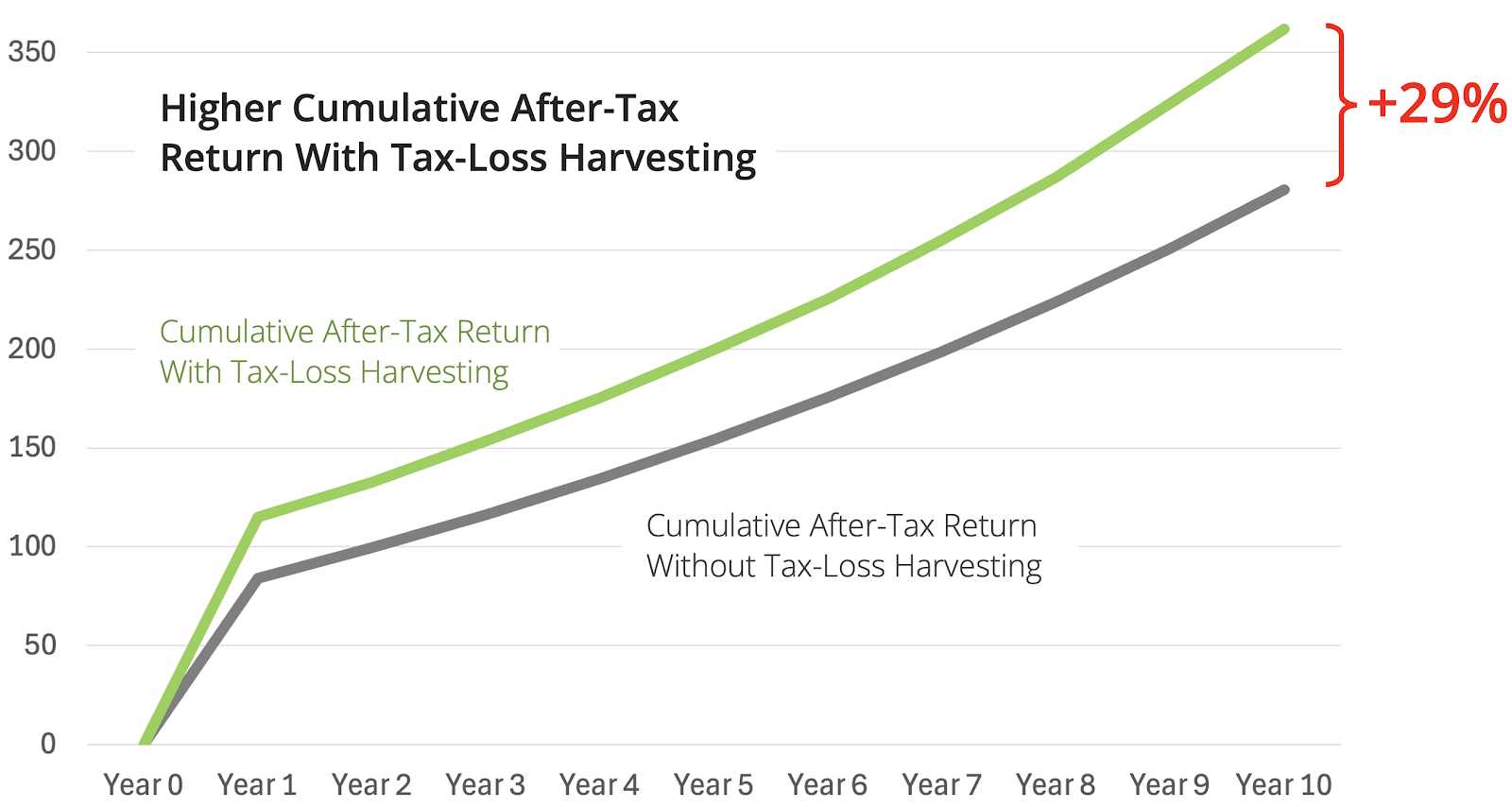

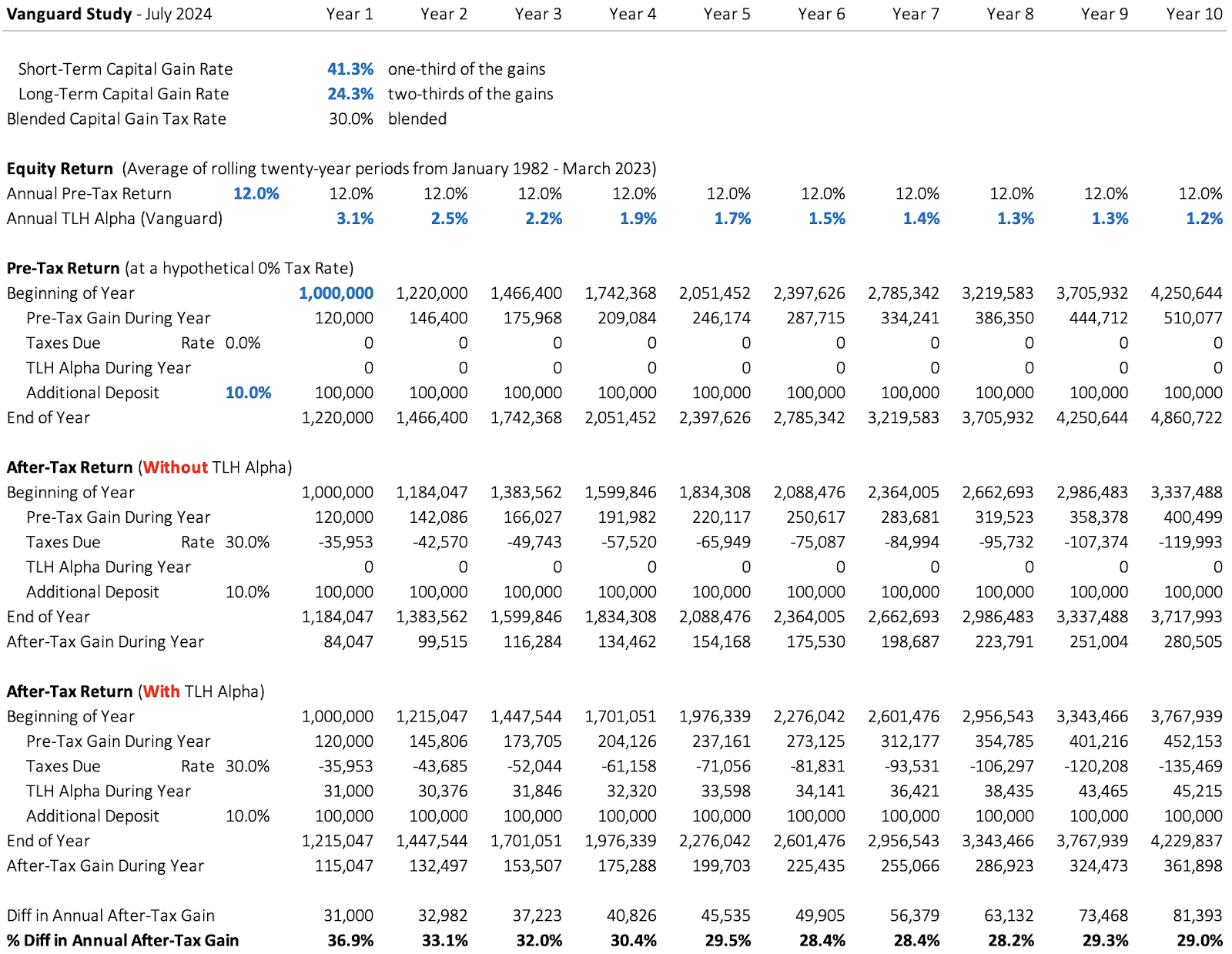

Research study shows a potential increase in after-tax performance of approximately 29% over ten years

For a high income taxpayer in a high tax state, tax-loss harvesting (TLH) can increase the after-tax performance of a group of stocks in a taxable account by approximately 29% versus the after-tax performance of a similar group of stocks without TLH held in an ETF or mutual fund.

This illustration is for informational purposes only and based on assumptions about tax rates, market performance, and investor profile which will vary widely. It does not represent actual client results or guarantee future outcomes. Tax-loss harvesting may not be suitable for all investors.

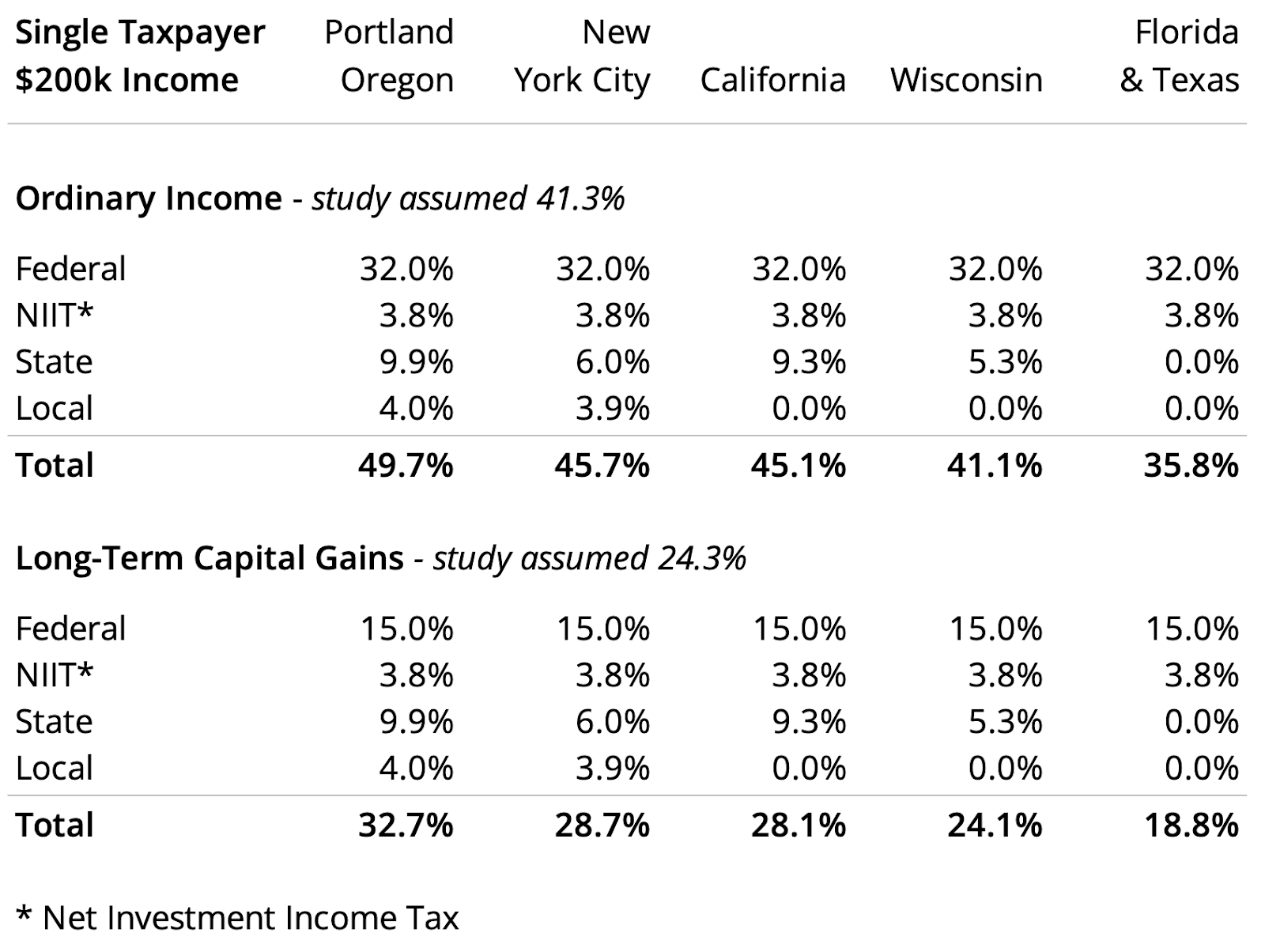

The key assumption driving this performance is the taxpayer’s marginal tax rates, which are assumed in the study to be 41.3% for ordinary income and 24.3% for long-term capital gains. This is the rough equivalent of a single taxpayer residing in Wisconsin with taxable income of $200,000.

These results are derived from a study by Thomas Paradise, CFA, Kevin Khang, Ph.D., and Joel Dickson, Ph.D., entitled Tax-loss harvesting: why a personalized approach is important, published by Vanguard Research in July 2024.

These results are derived from a study by Thomas Paradise, CFA, Kevin Khang, Ph.D., and Joel Dickson, Ph.D., entitled Tax-loss harvesting: why a personalized approach is important, published by Vanguard Research in July 2024.

RESULTS

Higher after-tax performance than a comparable equity ETF or mutual fund

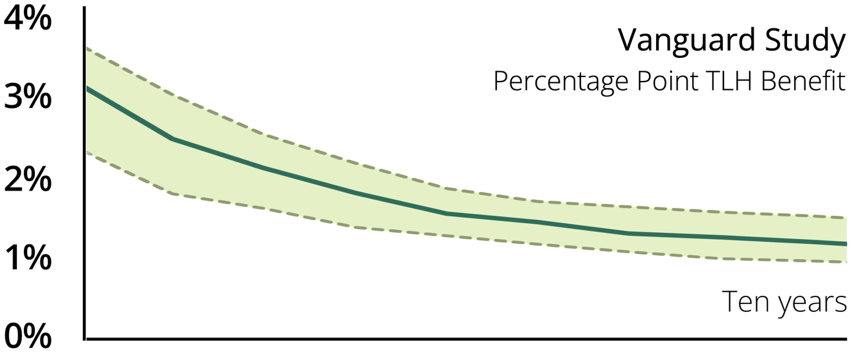

The results can be expressed in two ways which are mathematically equivalent. The first is by calculating the after-tax percentage point benefit of TLH, or “tax alpha”, which we shall call the “Percentage Point” calculation. The second is by calculating the percent increase in the after-tax return with TLH versus the after-tax return without TLH, which we shall call the “Percent” calculation.

According to the Percentage Point calculation from the study (see the chart below), the annual benefit of TLH over a ten year period starts at 3.1% in the first year and declines to 1.2% in the tenth year. The reason for this decline is that, as the price of most of the stocks increased over the ten-year period of the study, the number of stocks which generated harvestable losses declined over that period. This is known as “ossification”.

According to the Percentage Point calculation from the study (see the chart below), the annual benefit of TLH over a ten year period starts at 3.1% in the first year and declines to 1.2% in the tenth year. The reason for this decline is that, as the price of most of the stocks increased over the ten-year period of the study, the number of stocks which generated harvestable losses declined over that period. This is known as “ossification”.

Source: Vanguard study using historical market data (1982–2023). Results are hypothetical and for illustrative purposes only; they do not represent actual client outcomes. Individual results will vary based on portfolio composition, market conditions, and tax circumstances.

The Percentage Point calculation can be converted to a Percent calculation by dividing the increase in the Percentage Point after-tax return with TLH divided by the Percentage Point after-tax return without TLH. As an illustration of how the calculation is made, if the increase in the after-tax return with TLH was 2.0 percentage points and the after-tax return without TLH was 7.0 percentage points, the Percent increase in the after-tax performance of TLH would be 28.6% (2.0 percentage points divided by 7.0 percentage points).

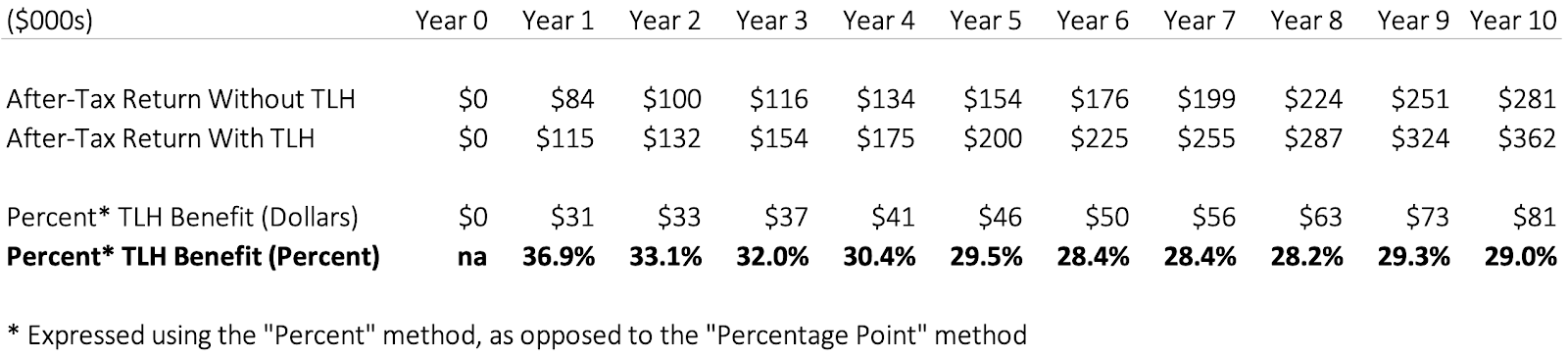

After conversion to the Percent calculation, the study shows an increase in the cumulative after-tax earnings of 36.9% in the first year declining to 29.0% in the tenth year. (Expressing the benefit of TLH using the Percent calculation is more intuitive for some investors.)

After conversion to the Percent calculation, the study shows an increase in the cumulative after-tax earnings of 36.9% in the first year declining to 29.0% in the tenth year. (Expressing the benefit of TLH using the Percent calculation is more intuitive for some investors.)

See the detailed spreadsheet in Exhibit 1 at the end of this paper.

In the later years, the percent improvement in the cumulative after-tax earnings with TLH is higher than the percent improvement in the Percentage Point calculation in any individual year. This is because of the compounding effect of improvements in the early years on the cumulative earnings in the later years.

Notes on the calculations: The average annual pre-tax total return on the S&P 500 was approximately 12% from 1982 through 2022, the period of the study. The study applied a blended tax rate to the 12% pre-tax return that was calculated using an assumption that one-third was ordinary income taxed at a 41.3% rate and two-thirds was capital gain taxed at a 24.3% rate, for a blended rate of 30.0%.

The study calculates the benefit of TLH during the ten-year period of the study without a liquidation of the stocks at the end of the period. If the stocks were eventually sold, this would result in the recognition of deferred capital gains and would generate tax on those gains at that time. However, the eventual tax on those unrealized capital gains could continue to be deferred and eventually could be reduced or eliminated through charitable giving, family gifting, stepped-up basis in an estate, or lower tax rates in retirement.

The study was conducted using the market-weighted stocks in the S&P 500. However, the same TLH method can be used on any group of stocks, whether selected using an index or an actively managed model, as long as the constituent positions in that index or model are regularly known throughout the period.

The constituents of publicly traded ETFs are known on a daily basis, whereas the constituents of most mutual funds are only known on a monthly basis and after a lag of 30-60 days. However, numerous larger mutual funds have sister ETFs which maintain the same model as the mutual fund itself. In these cases, the constituents of these mutual funds are also known on a daily basis.

Because TLH can improve the after-tax returns of any group of stocks, the logical conclusion is that TLH can produce higher after-tax performance than a comparable equity ETF or mutual fund.

In the later years, the percent improvement in the cumulative after-tax earnings with TLH is higher than the percent improvement in the Percentage Point calculation in any individual year. This is because of the compounding effect of improvements in the early years on the cumulative earnings in the later years.

Notes on the calculations: The average annual pre-tax total return on the S&P 500 was approximately 12% from 1982 through 2022, the period of the study. The study applied a blended tax rate to the 12% pre-tax return that was calculated using an assumption that one-third was ordinary income taxed at a 41.3% rate and two-thirds was capital gain taxed at a 24.3% rate, for a blended rate of 30.0%.

The study calculates the benefit of TLH during the ten-year period of the study without a liquidation of the stocks at the end of the period. If the stocks were eventually sold, this would result in the recognition of deferred capital gains and would generate tax on those gains at that time. However, the eventual tax on those unrealized capital gains could continue to be deferred and eventually could be reduced or eliminated through charitable giving, family gifting, stepped-up basis in an estate, or lower tax rates in retirement.

The study was conducted using the market-weighted stocks in the S&P 500. However, the same TLH method can be used on any group of stocks, whether selected using an index or an actively managed model, as long as the constituent positions in that index or model are regularly known throughout the period.

The constituents of publicly traded ETFs are known on a daily basis, whereas the constituents of most mutual funds are only known on a monthly basis and after a lag of 30-60 days. However, numerous larger mutual funds have sister ETFs which maintain the same model as the mutual fund itself. In these cases, the constituents of these mutual funds are also known on a daily basis.

Because TLH can improve the after-tax returns of any group of stocks, the logical conclusion is that TLH can produce higher after-tax performance than a comparable equity ETF or mutual fund.

ASSUMPTIONS

The investor is a high income taxpayer in a high tax state

The benefits of TLH are highly dependent on the situation of each individual investor. As stated by the authors of the study, “The value of tax-loss harvesting (TLH) varies significantly across investor characteristics, investor behavior and market conditions.”

Major driving assumptions include the current and future tax rates of the investor, the reinvestment of tax savings, the volatility of the stocks in the group, the market returns during the period, the availability of capital gains against which the tax losses can be offset, and the pattern of recurring investments during the period.

The most important factors are, in order of importance, tax rates, reinvestment, volatility, market returns, harvest frequency, capital gains, and recurring investments. The first three factors drive over two thirds of the variability in the benefits of TLH.

Major driving assumptions include the current and future tax rates of the investor, the reinvestment of tax savings, the volatility of the stocks in the group, the market returns during the period, the availability of capital gains against which the tax losses can be offset, and the pattern of recurring investments during the period.

The most important factors are, in order of importance, tax rates, reinvestment, volatility, market returns, harvest frequency, capital gains, and recurring investments. The first three factors drive over two thirds of the variability in the benefits of TLH.

Tax Rates. The marginal tax rates used in the study are 41.3% for ordinary income and 24.3% for long-term capital gains. The study examined four categories of taxpayers with capital gains tax rates between 15.0% and 31.3%. This paper uses the second highest of the four categories representing a moderately high income taxpayer in a moderately high tax state.

Note : Above table is based on assumed federal, state, and local tax rates for illustrative purposes only. Future tax laws, market conditions, and individual circumstances will differ.

The tax rates used in the study are roughly equivalent to the total tax rates for a single taxpayer with $200,000 taxable income residing in Wisconsin. Taxpayers in high tax areas like California, New York City and Portland, Oregon face a higher tax burden, while taxpayers in states like Florida and Texas which have no income tax have lower total tax rates. The higher the tax rates of the investor the higher the potential benefit from TLH.

In retirement, most people have lower incomes and therefore lower tax rates than they do when working. In addition, some retirees migrate to lower tax states. Because TLH defers the recognition of capital gains, the long-term benefit from TLH increases when tax rates are higher in the early working years and lower in the later retirement years. However, the study assumed the same tax rates in early and later years.

Reinvestment. Reinvestment of the dollar benefits of TLH is an important factor because it allows additional tax lots to be purchased at then-current prices which, for stocks that have appreciated, are higher than the tax lots purchased in prior periods. Reinvestment replenishes the pool of potential tax losses and mitigates ossification.

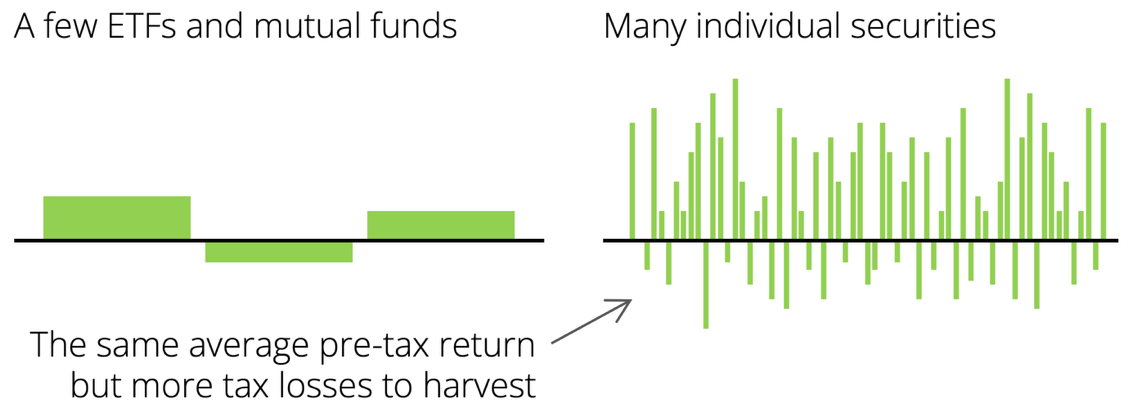

Volatility. Stocks with higher volatility (larger swings in their stock prices) produce greater benefits from TLH. This is because the downswings can create more tax-loss harvesting opportunities.

Even more important is the impact of direct indexing in which an index like the S&P 500 is held as a group of individual stocks rather than as a single ETF. The volatility is much higher for each of the individual stocks than for the average of 500 stocks. This creates a much larger and longer-lasting pool of harvesting opportunities, and therefore produces much greater benefits of TLH.

In retirement, most people have lower incomes and therefore lower tax rates than they do when working. In addition, some retirees migrate to lower tax states. Because TLH defers the recognition of capital gains, the long-term benefit from TLH increases when tax rates are higher in the early working years and lower in the later retirement years. However, the study assumed the same tax rates in early and later years.

Reinvestment. Reinvestment of the dollar benefits of TLH is an important factor because it allows additional tax lots to be purchased at then-current prices which, for stocks that have appreciated, are higher than the tax lots purchased in prior periods. Reinvestment replenishes the pool of potential tax losses and mitigates ossification.

Volatility. Stocks with higher volatility (larger swings in their stock prices) produce greater benefits from TLH. This is because the downswings can create more tax-loss harvesting opportunities.

Even more important is the impact of direct indexing in which an index like the S&P 500 is held as a group of individual stocks rather than as a single ETF. The volatility is much higher for each of the individual stocks than for the average of 500 stocks. This creates a much larger and longer-lasting pool of harvesting opportunities, and therefore produces much greater benefits of TLH.

For illustrative purposes only to simplify the potential impact of volatility on tax-loss harvesting and does not represent actual results.

TLH approaches often used by robo-advisors that rely on only a few broad-market ETFs per portfolio limit the number of opportunities to realize losses. In contrast, direct indexing holds hundreds of individual stocks, allowing for more frequent and precise tax loss harvesting.

Market Returns. The value of THL is highly dependent upon the market returns over the period. The study shows that the THL benefit is generally higher in ten-year periods during which the market goes down early in the period and up later in the period. This is because more losses can be harvested in the beginning of the period, before prices go up and make subsequent harvesting opportunities less frequent.

Harvest Frequency. The frequency with which the portfolio is monitored for harvesting opportunities also has a significant impact on the TLH benefit. Traditionally, investment advisors harvested tax losses once a year in December (or not at all). This method misses all the harvesting opportunities available throughout the year. In practice, higher frequency harvesting is not practical without modern software to automate the process while simultaneously minimizing the tracking error against the target portfolio.

Evaluating the group of stocks and their individual tax lots for potential loss capture on a more frequent basis – monthly or even daily – maximizes the THL benefit substantially.

Capital Gains. Tax losses are valuable to the extent they offset other taxes. This can be achieved by (1) using the $3,000 annual deduction allowance against ordinary income from salary and other compensation, which is particularly valuable because it is otherwise taxed at the higher ordinary income rate, (2) offsetting short-term capital gains in the group of stocks, which are also taxed at the higher ordinary income tax rate, (3) offsetting long-term capital gains in the group of stocks, (4) offsetting short-term and long-term capital gains from other sources outside the group of stocks, and (5) carrying over any excess unused losses to future tax years.

Recurring Investments. The study assumes a cash investment of $1,000,000 at the beginning of the period and additional annual investments of $100,000. The additional investment allows new tax lots of appreciated stocks to be purchased at the then-current higher prices, which are more likely to create harvesting opportunities and mitigate the effects of ossification. Without continuing deposits, the dampening effect of ossification appears somewhat earlier. However, the study found this had a relatively minor impact to the benefit of TLH.

Exhibit 1

Cumulative Impact of Tax-Loss Harvesting over Ten Years

Market Returns. The value of THL is highly dependent upon the market returns over the period. The study shows that the THL benefit is generally higher in ten-year periods during which the market goes down early in the period and up later in the period. This is because more losses can be harvested in the beginning of the period, before prices go up and make subsequent harvesting opportunities less frequent.

Harvest Frequency. The frequency with which the portfolio is monitored for harvesting opportunities also has a significant impact on the TLH benefit. Traditionally, investment advisors harvested tax losses once a year in December (or not at all). This method misses all the harvesting opportunities available throughout the year. In practice, higher frequency harvesting is not practical without modern software to automate the process while simultaneously minimizing the tracking error against the target portfolio.

Evaluating the group of stocks and their individual tax lots for potential loss capture on a more frequent basis – monthly or even daily – maximizes the THL benefit substantially.

Capital Gains. Tax losses are valuable to the extent they offset other taxes. This can be achieved by (1) using the $3,000 annual deduction allowance against ordinary income from salary and other compensation, which is particularly valuable because it is otherwise taxed at the higher ordinary income rate, (2) offsetting short-term capital gains in the group of stocks, which are also taxed at the higher ordinary income tax rate, (3) offsetting long-term capital gains in the group of stocks, (4) offsetting short-term and long-term capital gains from other sources outside the group of stocks, and (5) carrying over any excess unused losses to future tax years.

Recurring Investments. The study assumes a cash investment of $1,000,000 at the beginning of the period and additional annual investments of $100,000. The additional investment allows new tax lots of appreciated stocks to be purchased at the then-current higher prices, which are more likely to create harvesting opportunities and mitigate the effects of ossification. Without continuing deposits, the dampening effect of ossification appears somewhat earlier. However, the study found this had a relatively minor impact to the benefit of TLH.

Exhibit 1

Cumulative Impact of Tax-Loss Harvesting over Ten Years

*These figures are illustrative only, based on assumed tax rates, contributions, and market returns. They do not represent actual results or guarantee future performance. Outcomes will vary with individual portfolios, taxes, and market conditions. Full calculation details are available upon request.

Vanguard Study: https://corporate.vanguard.com/content/dam/corp/research/pdf/tax_loss_harvesting_why_a_personalized_approach_is_important.pdf

Disclaimer:

This blog is provided for informational and educational purposes only and is intended to illustrate the potential benefits of tax-loss harvesting (“TLH”) strategies. The scenarios and figures discussed are based on historical market data, assumptions about tax rates, and illustrative modeling, and are not guarantees of future outcomes. Results are hypothetical and do not reflect actual client accounts, transactions, or advice.

Tax-loss harvesting may not be suitable for all investors and its effectiveness depends on many factors, including market conditions, portfolio composition, tax rates, and individual circumstances. Future tax laws and regulations may also affect results. This material should not be construed as investment, tax, or legal advice, and should not be relied upon as such.

All investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. Before making any financial decisions, you should consult your own qualified tax, legal, and financial advisors to determine whether any strategy is appropriate for your specific situation.

Evergreen Wealth Advisors is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training.

This blog is provided for informational and educational purposes only and is intended to illustrate the potential benefits of tax-loss harvesting (“TLH”) strategies. The scenarios and figures discussed are based on historical market data, assumptions about tax rates, and illustrative modeling, and are not guarantees of future outcomes. Results are hypothetical and do not reflect actual client accounts, transactions, or advice.

Tax-loss harvesting may not be suitable for all investors and its effectiveness depends on many factors, including market conditions, portfolio composition, tax rates, and individual circumstances. Future tax laws and regulations may also affect results. This material should not be construed as investment, tax, or legal advice, and should not be relied upon as such.

All investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. Before making any financial decisions, you should consult your own qualified tax, legal, and financial advisors to determine whether any strategy is appropriate for your specific situation.

Evergreen Wealth Advisors is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training.