Keep More of

What You Earn

Tax strategy is integrated into your portfolio everyday.

After Tax Returns

Most firms focus on performance before taxes. We focus on what you keep, not just what you earn. Our Dynamic Portfolio proactively optimizes your tax picture screening for losses to harvest daily, deferring gains, and applying asset location strategies to improve after-tax results across your accounts.

higher after-tax performance

than comparable equity ETFs and mutual funds

12 Advanced Tax Strategies

Direct Indexing

Tax-Loss Harvesting

Tax Transitions

Tax Exempt Bonds

Retirement Accounts

Asset Location

Tax-Gain Harvesting

Family Gifting

Charitable Giving

Estate Transfers

Education & Medical

Company Equity

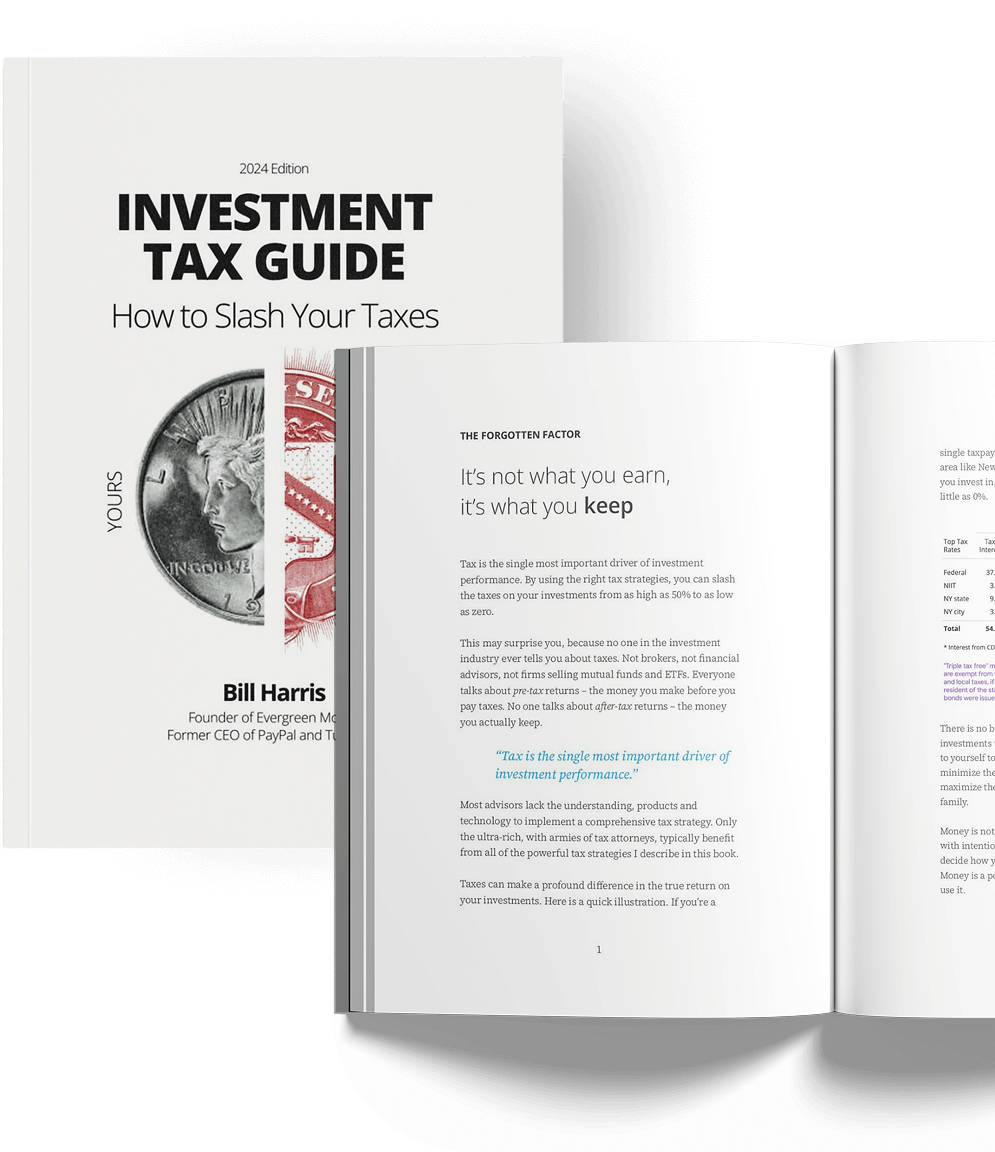

I Wrote the Book on Investment Taxes

“And I’d like you to have a complimentary copy. You’ll learn the tax strategies that can reduce or, in some cases, eliminate taxes on your investments.”

Bill Harris, Founder of Evergreen Wealth

Talk to a fiduciary advisor about

tax-smart investing.

Explore the Moves

Behind the Strategies

QSBS Tax Strategy: How You Could Potentially Reduce or Eliminate Taxes on Startup Equity

What many startup employees don’t know about QSBS could cost them millions in unnecessary taxes.

Year-End Tax Planning for High Earners 2025: Gift Exclusions, QCDs & Strategies to Help Reduce Taxes Before December 31

The decisions you make before December 31 could impact your after-tax results for years to come.

Year-End Tax Planning for High Earners 2025: Gift Exclusions, QCDs & Strategies to Help Reduce Taxes Before December 31

The decisions you make before December 31 could impact your after-tax results for years to come.

Tax Strategies Are Complicated.

Answers Shouldn’t Be.

We use a combination of advanced tax strategies, like daily tax-loss harvesting, smart asset location, gain deferral, and charitable giving, to help reduce tax drag and improve your overall after-tax return. These strategies are coordinated across your accounts and tailored to your portfolio, values, and individual tax profile.

Tax-loss harvesting is a tax strategy used to help reduce the taxes you owe on investment gains. It involves selling investments that have declined in value to realize a loss, while offsetting potential gains from other investments that have been sold at a gain. At Evergreen Wealth, we look for harvesting opportunities daily as part of our daily optimization process, while considering IRS wash sale rules that may impact your transactions.

No. Our tax optimization process is built to follow IRS wash-sale rule guidelines. When we harvest losses, we reinvest in substantially similar, but not identical, securities to help ensure the losses remain deductible while keeping your portfolio aligned with its target. This approach aligns with IRS compliance requirements.

Yes. We use asset location strategies to place investments in the accounts where they are most tax-efficient. Income-generating assets typically go in IRAs, tax-advantaged growth fits in Roth accounts, and tax-efficient investments like municipal bonds may stay in taxable accounts. This approach is designed to help improve long-term tax efficiency and reduce your overall tax burden.

Evergreen Wealth uses a wide range of tax strategies designed to help manage the impact of high state and federal taxes. That includes daily tax-loss harvesting, smart asset location, gain deferral, and other advanced techniques tailored to your financial picture. We work across accounts to help reduce tax drag, so more of your money stays invested and working toward your long-term goals.